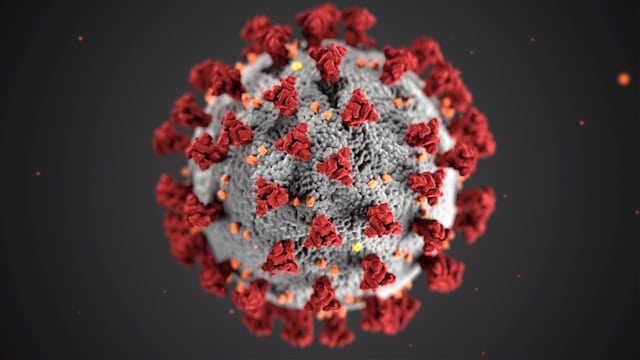

January 21, 2020 is a date the history books will surely remember: this was the day that the United States confirmed its first case of the novel coronavirus COVID-19. And once again this week, two months after that fateful first case of COVID-19 was detected in the U.S., we can now add another date to the history books: Wednesday, March 18, 2020 – the date that the United States government passed The Families First Coronavirus Response Act.

This Act is the second emergency aid package related to COVID-19 that the U.S. Federal Government has passed since the start of this pandemic, but it might be the more important of the two packages for individual Americans.

The first aid package, passed on Friday, March 6, 2020, was an emergency funding package “which allocated roughly $8 billion for coronavirus prevention, preparation and response efforts.” However, despite the bill’s expansive allocations of aid for the public health system, the Federal Government recognized that this bill did little for individual Americans and American families across the nation.

“While the $8.3 billion coronavirus supplemental we enacted into law was a crucial step [that] stabilized our public health system, more support for working families [was] clearly needed,” explained Rep. Nita M. Lowey of New York, Chairwoman of the House Appropriations Committee.

To respond to the growing needs of American families during the current “coronavirus outbreak,” the House Appropriations, Budget, and Ways and Means Committees sponsored and successfully secured the passage of the Families First Coronavirus Response Act.

Effective April 2, 2020, the Families First Coronavirus Response Act will offer assistance with both the health and economic crises facing Americans today. By suspending some rules, implementing other new ones, and expanding some preexisting protections, this expansive bill will affect the lives of Americans in multiple major ways.

“[This] legislation puts working families first by providing new resources and more protections as our country faces this public health emergency.”

The Families First Coronavirus Response Act offers the following four guarantees:

(1) You can now get FREE COVID-19 TESTING.

The basics:

- For Americans on group health insurance plans, individual health insurance, or Medicaid, COVID-19 testing is now completely covered – with zero cost-sharing.

- This coverage applies to both the costs of the test itself and to the costs of the visit in which the test was administered.

- Americans will not be liable for any deductibles, copayments, or coinsurance for items or services provided during the visit.

How it’s possible:

- The Act includes a variety of waivers that allow testing costs to be covered by either the insurance companies or government programs.

- The Act also includes a temporary 6.2% increase in federal payments to Medicaid for states.

- Multiple million-dollar lumps are to be distributed to the Department of Veterans Affairs, the Indian Health Service, and the National Disaster Medical System to preemptively cover costs of testing veterans, Native Americans, and those without health insurance.

(2) If you don’t have food security, the government will provide you FREE MEALS.

The basics:

- The Supplemental Nutrition Assistance Program (SNAP) has been modified to expand who qualifies for these benefits. One such way SNAP has been modified is that it no longer requires proof that you have a job in order to qualify for free food.

- • Additionally, American households will be eligible for nutrition help if a child’s school has been closed for at least five consecutive days because of the health crisis.

How it’s possible:

- The Act allocates nearly a billion dollars to nutrition assistance for those who do not have secure access to meals.

- This Act specifically allocates 400 million dollars for the creation of an emergency food assistance program that will be available through Sept. 30, 2021.

- An additional 100 million dollars has been allocated for nutrition assistance grants to provide for all the U.S. territories.

(3) If you’ve been laid off, you are likely going to be able to COLLECT FULL UNEMPLOYMENT BENEFITS.

The basics:

- This Act boosts unemployment benefits tenfold in the hopes of stabilizing the unemployment system.

- All states are being provided extra funds for their unemployment programs, with higher amounts of assistance going to states that already have high unemployment rates or those states that have already completely exhausted their available unemployment benefits.

How it’s possible:

- The Act includes one billion dollars in state grants to cover the processing and paying of unemployment insurance.

(4) If you’re sick, the government will PAY YOU TO STAY HOME.

The basics:

- These portions of this Act apply only to employers who employ less than 500 employees.

- This Act requires that covered employers must provide paid leave for all employees affected by the coronavirus, regardless of the employees’ duration of employment, if those employees are unable to work or telework.

- Specifically, employer must now provide an additional two full weeks (or 80 hours) of paid sick time at the employee’s regular rate of pay to every full-time employee who is unable to work or telework because of COVID-19.

- Additionally, an employer must now also provide paid sick time at the employee’s regular rate of pay to every part-time employee who is unable to work or telework because of COVID-19. However, instead of a blanket two weeks, part-time workers can take paid sick leave for up to the number of hours the employee works on average in a two-week window.

o NOTE: For both part-time and full-time employees, the regular rate of pay the Act requires for sick leave may be reduced to two-thirds pay if the employee’s leave is taken to care for others, such as a sick or quarantined family member or a child whose school is closed. - An employer must also grant an additional ten weeks of FMLA leave for those who must stay at home to care for a child whose school or daycare is closed. These ten weeks will also be paid at two-thirds the employee’s regular rate of pay.

How it’s possible:

- This portion of the Act builds on and temporarily expands the pre-existing Family and Medical Leave Act (FMLA).

- This Act also establishes a federal emergency paid leave benefits program to provide payments to employees taking unpaid leave due to the coronavirus outbreak.

- Additionally, the Act provides for payroll tax credits to offset the costs of providing paid sick leaves for so many.

This Act is monumental – both because of its length and its significance. This new piece of emergency legislation bends rules and uproots others, but more importantly, it offers a bit of tangible hope to the frightened American families across this nation.